Non-major lenders have started offering another 5,000 slots for the First Home Loan Deposit Scheme, which allows first home buyers to purchase a property with a deposit of 5% without... read more →

A question that’s been popping up a bit lately has been ‘why didn’t my lender reduce my repayments when the interest rate fell last year?’ It’s a good and timely... read more →

Applications for the new First Home Loan Deposit Scheme are now open, with 10,000 guarantees available to first home buyers looking to get a leg up into the property market.... read more →

Got a pool you’re constantly scooping leaves out of but never use? Or perhaps you’re looking to cool off this summer in the privacy of someone else’s backyard. Well, a... read more →

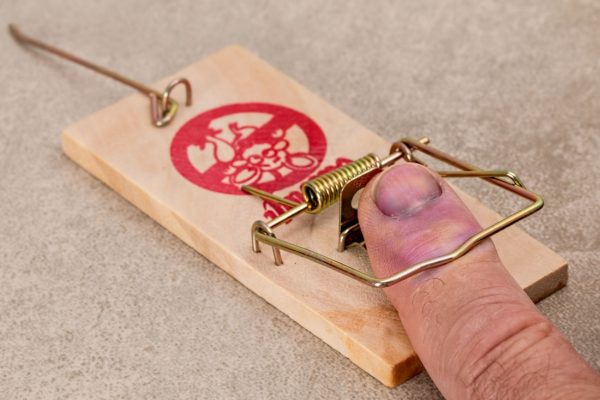

Predatory payday lenders are profiting from vulnerable Australians and trapping them in spiralling debt, according to a collaborative report by 20 consumer advocacy bodies. The report, The Debt Trap: How... read more →

Looking to refinance your home loan? A valuation is a vital part of the process. So today we’ll look at some ways you can help get your home in tip-top... read more →

The property price caps in each state have been revealed for the federal government’s new first home buyer scheme. Read on to find out the maximum value of a property... read more →

Are you paid weekly, fortnightly or monthly? New research indicates that how often you’re paid has a pretty big bearing on whether you’re a saver or a spender. The research,... read more →

You know that infuriating habit the big banks have of failing to pass on the RBA’s cash rate cuts in full? Well, it’s finally triggered the federal government to order... read more →

The ‘pendulum may have swung a bit too far’ when it comes to the tight lending standards currently imposed on small businesses, says the Reserve Bank of Australia (RBA). Since... read more →